- Finest total Stripe various: Sq.

- Least expensive Stripe various: Helcim

- Finest Stripe various for ease of use: PayPal

- Finest Stripe various for integrations and fraud safety: Authorize.internet

- Finest Stripe various for account stability: Adyen

- Finest Stripe various for Shopify retailers: Shopify Funds

- Finest Stripe various for high-risk companies: PaymentCloud

Stripe is a highly-rated and well-liked cost processor by customers and consultants alike due to its customizable instruments, security measures, and skill to just accept many cost strategies. Nonetheless, there are some conditions when Stripe isn’t the most suitable choice, equivalent to the necessity for robust omnichannel gross sales, an easy-to-use setup, and decreased or discounted processing charges.

Prime Stripe alternate options comparability

The very best alternate options to Stripe are suppliers that surpass Stripe in sure standards throughout my analysis or supply a characteristic that Stripe lacks. The desk compares these cost processors like Stripe primarily based on ease of use, platform compatibility, and related prices.

| Beginning value (per 30 days) | On-line transaction payment |

Similar-day payouts | Ease of use | Platform compatibility | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sq. | $0 | 2.9% + $0. 30 | 1.75% | Wonderful | Unique | |||||||

| Helcim | $0 | Interchange plus 0.15% + $0.15 | N/A | Good | Restricted | |||||||

| PayPal | $0-$30 | 2.99% + $0.49 | 1.5% | Wonderful | Wonderful | |||||||

| Authorize.internet | $25 | 2.9% + $0.30 or $0.10 | No charges | Good | Wonderful | |||||||

| Adyen | $0 | Interchange + $0.13 | Undisclosed payment, if any | Good | Wonderful | |||||||

| Shopify Funds | $0 | 2.4% + $0.30 | N/A | Wonderful | Unique | |||||||

| PaymentCloud | $10-$45 | 2%-4.3% | N/A | Good | Wonderful | |||||||

Sq.: Finest total Stripe various

Sq. is an all-in-one POS resolution that facilitates in-person, on-line, and cell funds. In the case of Stripe vs Sq., the latter supplies retailers with a cost gateway to just accept funds via point-of-sale {hardware} (that in addition they present) and on-line (that in addition they present an avenue for via an e-commerce web site builder). Even higher, Sq. gives these at zero value, making it a really engaging possibility for all enterprise sizes.

Sq.’s free choices are additionally not limiting — they’re sturdy sufficient to be a totally viable possibility for startups and companies primed for development.

Why I selected Sq.

Whereas each Stripe and Sq. don’t cost month-to-month charges and supply flat-rate pricing, Sq. has these benefits: it has decrease processing charges for card-present or in-person transactions, gives free POS and e-commerce instruments, and extra card reader choices which are cheaper.

Stripe has larger charges for in-person transactions and requires integrations for POS and e-commerce builders. It additionally has restricted card reader choices for in-person promoting because it’s primarily an internet cost processor.

Sq. is the very best Stripe various if funds, ease of use, and fast set up are priorities. It has no month-to-month charges and gives free omnichannel promoting instruments (POS, card reader, and e-commerce builder). Sq. can get you arrange and began in a number of easy steps, with no coding data required. It additionally comes with scalable options that may assist enterprise development. Customized pricing is offered upon request for enterprises.

Pricing

- Subscription payment: $0.

- On-line transaction: 2.9% + 30 cents.

- Bill processing: 2.9% + 30 cents or 3.5% + 15 cents if processed utilizing Card on File.

- ACH transaction payment: 1% processing payment, minimal $1.

- Recurring billing: 3.5% + 15 cents.

- Chargeback payment: $0 (waived as much as $250 per 30 days).

Options

- Versatile POS system that grows with your corporation.

- Omnichannel cost processing.

- Deposit pace — normal 1–2 days, 1.75% payment for immediate funding.

- Inclusion of a free e-commerce web site builder.

- Buyer assist — Monday-Friday cellphone assist, 24/7 automated chat assist.

Execs and cons

| Execs | Cons |

|---|---|

| Free user-friendly POS and on-line retailer. | Not fitted to high-risk companies. |

| No month-to-month charges or minimums. | Unique to Sq.. |

| Omnichannel cost processing instruments. | Developer-based options just for enterprise accounts. |

Helcim: Least expensive Stripe various

Helcim is a service provider account supplier providing sturdy cost processing options — together with assist for on-line, in-person, invoicing, recurring billing, digital terminal, and ACH funds. Its largest benefit over Stripe is its interchange-plus pricing construction with automated quantity reductions, making it the most affordable Stripe various for enterprise house owners.

B2B companies and people with massive gross sales volumes, notably above $50,000 a month, will particularly profit from Helcim’s pricing, as that’s the place Helcim’s quantity low cost begins.

Why I selected Helcim

I selected Helcim as my prime choose for the very best B2B cost processor and Stripe various primarily due to its cost-effectiveness. Helcim supplies aggressive pricing (interchange plus) and automated quantity reductions for these dealing with greater than $50,000 in month-to-month gross sales. With Stripe, you solely get flat-rate and {custom} pricing, which may get expensive as you improve gross sales.

Helcim additionally gives zero-cost processing (automated compliant surcharging), which helps you to legally go on bank card prices to clients, saving on charges. Stripe solely has handbook surcharging. Lastly, Helcim has free invoicing and recurring billing, which it’s essential to pay further for in Stripe. Helcim additionally consists of stage 2 and three information optimization applications (to qualify for low B2B interchange charges) at no further value.

Total, Helcim beats Stripe on the subject of saving on prices and charges and supplies free instruments which are appropriate for B2B funds. Its restricted integrations might be the dealbreaker for some, though Stripe has an in depth record. However for these wanting to save lots of on charges and maximize earnings primarily based on gross sales volumes, Helcim is the very best Stripe various.

Pricing

- Month-to-month payment: $0.

- Cost gateway payment: $0.

- Cost processing charges:

- Interchange plus 0.15-0.4% and 6-8 cents per card-present transactions.

- Interchange plus 0.15%-0.50% and 15-25 cents per card-not-present transaction.

- Plus 1% worldwide gross sales (Helcim specified this payment is bank-imposed and never a markup on its finish.)

- Interchange plus 0.15%–0.5% + 15–25 cents for invoicing.

- Interchange plus 0.15%–0.5% + 15–25 cents for recurring billing.

- 0.5% + 25 cents per transaction for home ACH transfers.

- Plus 0.10% + 10 cents for American Specific (AmEx) transactions.

- Chargeback payment: $15, refundable.

- Deposit pace: 2 enterprise days.

Options

- Interchange plus pricing with automated quantity reductions.

- Free worldwide bank card cost processing. (Be aware: A global service payment (1%-3%) could also be charged by your financial institution.)

- Payment Saver Program, which is a zero-cost processing program that mechanically detects the free bank card processing program accessible to make use of primarily based on the cardboard kind/community and enterprise location.

- Constructed-in Degree 2 and three information processing.

- Assist for frequent B2B funds — digital terminal, invoicing, recurring billing.

- Buyer self-service portal.

- Guided chargeback dispute decision.

- Credit score Card Vault — retailer and shield clients’ bank cards on file.

- Fraud Defender — danger estimation finished for every transaction for fraud and chargeback discount.

Execs and cons

| Execs | Cons |

|---|---|

| Computerized quantity low cost. | Restricted integrations. |

| Free entry to all cost instruments. | Strict approval course of for service provider accounts. |

| Constructed-in compliant surcharging and Degree 2 and three information optimization. | Gradual deposit pace; no prompt payouts. |

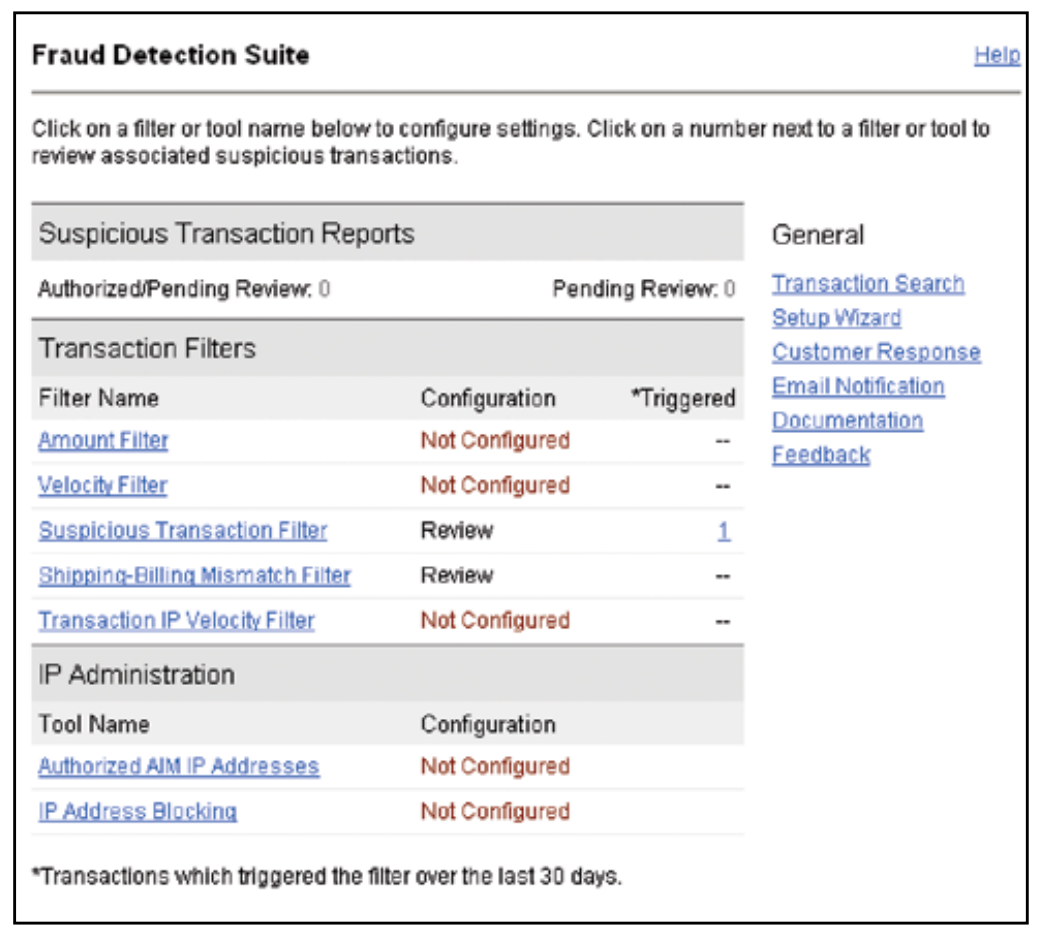

PayPal: Finest Stripe various for ease of use

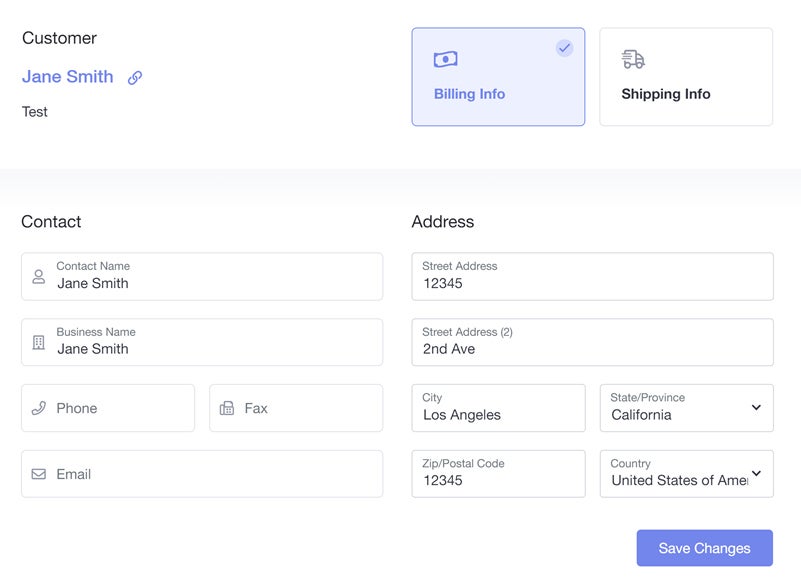

PayPal is a family identify on the subject of on-line funds, utilized by thousands and thousands of shoppers world wide. Retailers can use PayPal enterprise to just accept world funds from clients via numerous channels (on-line and in-person) and strategies (bank cards, cryptocurrencies, QR codes, BNPL, and extra).

PayPal’s straightforward integration course of additionally streamlines the web cost setup throughout numerous platforms. It even supplies a hosted and customizable checkout web page you’ll be able to simply embed in different platforms, equivalent to social media.

Why I selected PayPal

Whereas PayPal has a sophisticated pricing construction and faces the identical person reviews of frozen funds and accounts held by Stripe, it has benefits over Stripe, equivalent to assist for cryptocurrency and BNPL funds. Actually, PayPal is the one one featured on this record that has a local BNPL cost possibility; the remainder solely gives the choice via integrations with companions.

The presence of a PayPal button in a checkout button amplifies shopper belief instantly, incomes itself a spot in my advisable e-commerce cost options. Finally, PayPal earned a spot as a superb Stripe various due to its ease of use for each companies and clients. I additionally suggest including PayPal as a secondary or various on-line cost possibility due to the excessive shopper belief within the model.

Pricing

PayPal has essentially the most complicated payment construction of the businesses on our record, with particular charges for various currencies and international locations of origin. Beneath are some charges for U.S.-based companies for comparability. See PayPal’s web site for extra data.

- Month-to-month account payment: $0.

- Cost gateway payment: $0–$25 per 30 days.

- Recurring billing: $10 per 30 days.

- On-line card processing charges: 2.59%–2.99% + 49 cents.

- Worldwide processing charges: Plus 1.5%.

- Forex conversion charges: Plus 4%.

- Digital terminal: $0 to $30 per 30 days.

- Cryptocurrency conversion payment: 1%.

- Chargeback payment: $0–$20.

- Dispute charges: $15 for traditional transactions; $30 for high-volume transactions.

- Immediate withdrawal: 1.50% of payout quantity.

Options

- Accepts Venmo and cryptocurrency funds.

- Native Purchase Now, Pay Later (BNPL) cost choices.

- In-person funds by way of PayPal Zettle.

- Prebuild and custom-hosted checkout pages.

- Embeddable “Purchase Now” or “Pay Now” button with PayPal’s cost button generator.

- Chargeback safety.

- Deposit pace — same-day deposits to personal PayPal account, two to a few days to a daily checking account.

- Buyer assist — prolonged enterprise hours for dwell buyer and technical assist. Its cellphone assist is offered from 6:00 a.m. to six:00 p.m. Pacific Time, Monday via Sunday.

Execs and cons

| Execs | Cons |

|---|---|

| Extremely trusted and broadly well-liked platform. | Advanced and excessive payment construction. |

| Seamless and broadly accessible on-line checkout integration. | Stories of unpredictable account holds and freezing of funds. |

| No month-to-month charges or minimums. | Digital terminals value further. |

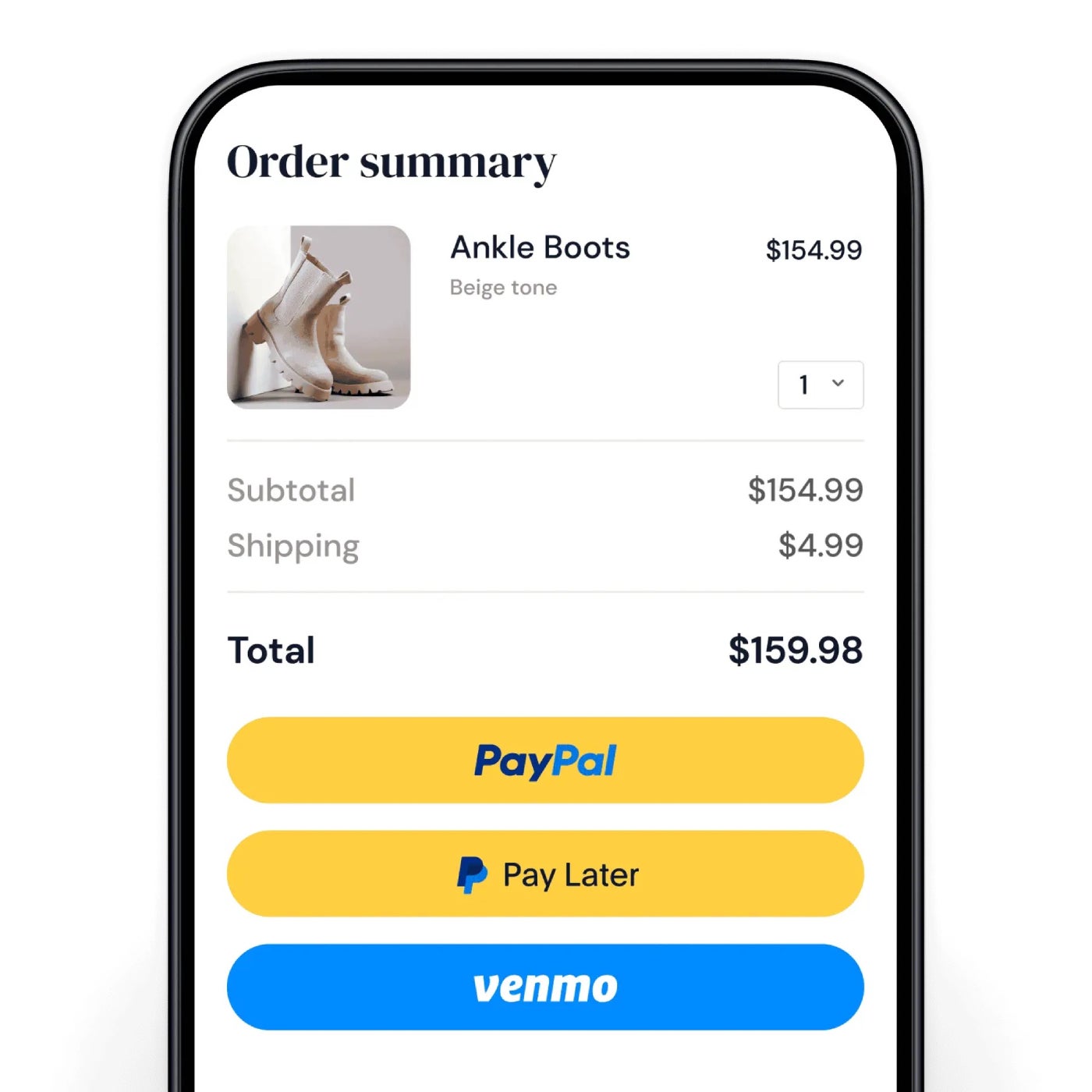

Authorize.internet: Finest Stripe various for integrations and fraud safety

Authorize.internet is without doubt one of the oldest and most trusted cost gateways. It’s a extremely versatile resolution that lets companies use their present or most well-liked service provider accounts or subscribe to an all-in-one resolution, which units them up with Authorize.internet’s accomplice service provider account suppliers.

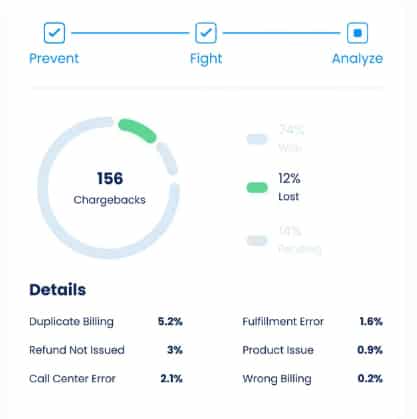

Authorize.internet rivals Stripe with its intensive record of integrations, too. Nonetheless, what units Authorize.internet aside is its extremely respected fraud detection device, Superior Fraud Detection Suite, which has greater than a dozen customizable fraud filters that assist shield in opposition to suspicious transactions.

Why I selected Authorize.internet

As the most effective cost gateways, Authorize.internet doesn’t cost further charges for utilizing its invoicing and recurring cost service, although Stripe does. It is usually one of many two options featured on this record that may service high-risk retailers, which is one thing Stripe can’t do. I like that it’s just like Stripe by way of intensive integrations and API extensions and likewise supplies built-in stage 2 and three information optimization applications like Helcim, which it’s good to do by way of integrations with Stripe.

Pricing

- Month-to-month payment: $25.

- Cost processing charges: 2.9% + 30 cents.

- Worldwide funds: 1.5% per transaction.

- ACH: 0.75% per transaction.

- Verbal authorization: $1.20 per transaction.

- Cost service charges: $0 for recurring billing service, fraud detection, and buyer administration.

Options

- Select between a cost gateway-only plan or an all-in-one plan that comes with a service provider account.

- Full Degree 2 and Degree 3 cost processing.

- Open API for {custom} integrations.

- Integrations for 145 software program from POS {hardware} to accounting methods.

- 160 software program growth platform companions.

- Superior Fraud Detection Suite (AFDS) device.

- Buyer Data Administration (CIM) device can save playing cards on file and as much as 10 funds and 100 transport particulars.

- Account updater, digital terminal, invoicing instruments, recurring funds.

- Payout inside 24 hours (no charges).

- 24/7 buyer assist.

Execs and cons

| Execs | Cons |

|---|---|

| Greater than 900 integrations and greater than 400 licensed know-how companions. | Restricted reporting options. |

| Works as a cost gateway and cost processor. | Restricted in-person cost options. |

| Works with present service provider accounts. | Outdated person interface (dashboard). |

| Extremely dependable. | Month-to-month charges make it costly for small companies. |

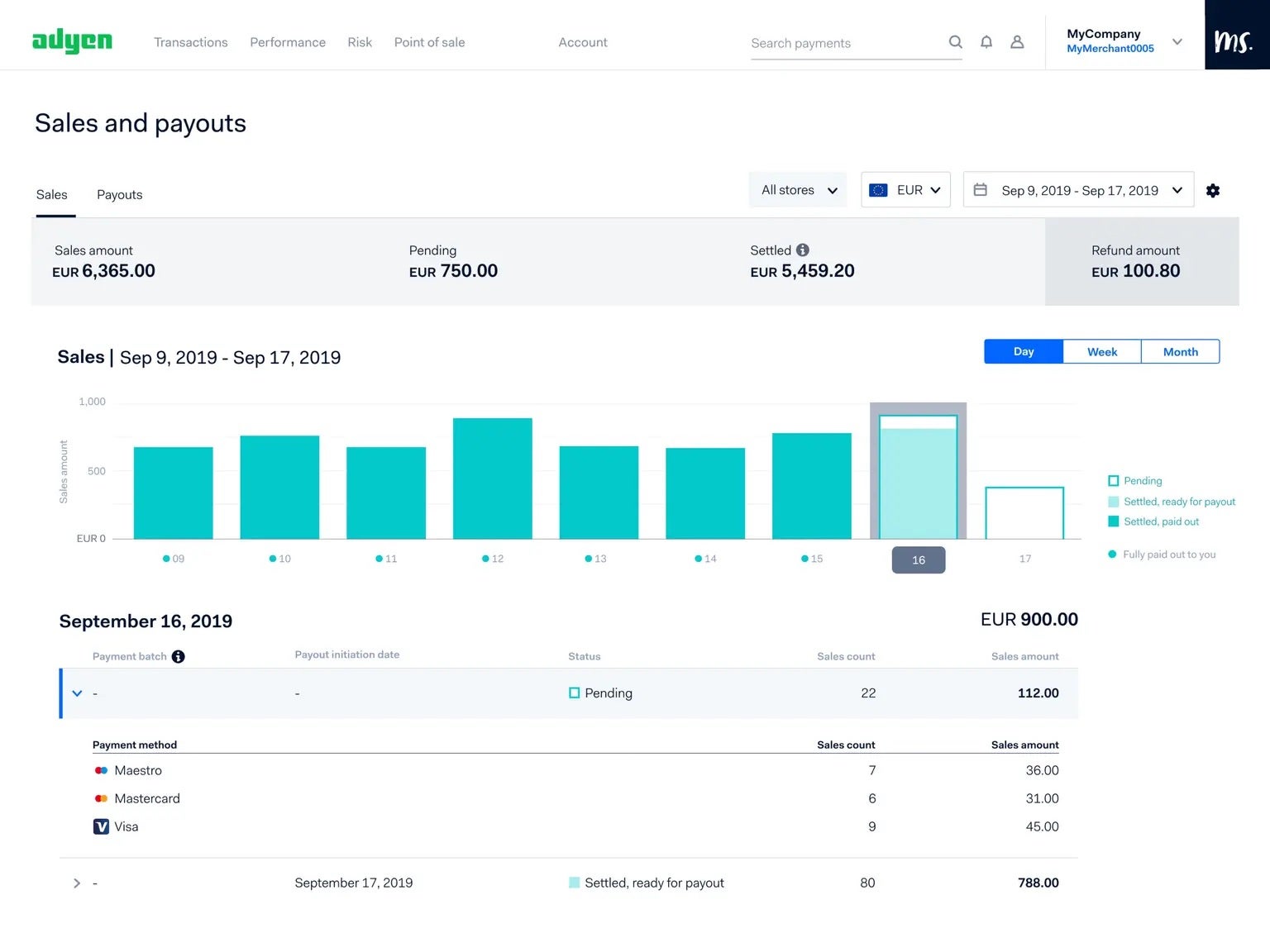

Adyen: Finest Stripe various for account stability

Adyen is a worldwide devoted service provider account supplier and direct cost processor with top-notch safety instruments, intensive partnerships with native banks, interchange plus pricing, and out-of-the-box and {custom} API options.

Adyen is a good Stripe various as a result of it isn’t a cost aggregation platform like Stripe; retailers have their very own devoted service provider accounts, giving them management over their cost infrastructure and lowering their danger of frozen funds.

Why I selected Adyen

I selected Adyen due to its affordability and out-of-the-box options, which make it a stable various to Stripe, along with its being a devoted service provider account. Adyen comes an in depth second to Stripe in my analysis of greatest worldwide cost gateways and is especially the most affordable possibility for world high-volume and B2B companies.

Adyen has higher ACH processing charges than Stripe (40 cents markup per transaction vs 0.8% with a $5 cap) and gives interchange plus pricing. It lets retailers save even with its $120 month-to-month gross sales minimal.

One other characteristic that makes it a superb various to Stripe and even PayPal is its user-friendly design. Whereas builders can nonetheless customise Adyen utilizing APIs, it additionally offers out-of-the-box software program choices, making it straightforward to make use of for non-technical customers.

Pricing

- Month-to-month payment: $0.

- Month-to-month minimal gross sales: $120.

- Processing charges:

- Interchange + 13 cents for Visa and MC, 3.3% + 23 cents for AmEx, 3%–3.95% + 13 cents for different card manufacturers for in-person transactions.

- Interchange + 13 cents for Visa and MC, 3.3% + 23 cents for AmEx, 3%–3.95% + 13 cents for different card manufacturers for on-line transactions.

- Cost providers charges:

- Invoicing: $0.

- ACH: 13 cents plus 27 cents markup per transaction.

- Chargeback payment: $5-$100, non-refundable.

- Deposit pace: Per programmed schedule or fast (manually).

Options

- Devoted service provider account.

- Superior fraud detection and prevention instruments.

- Unified commerce — multiplatform and omnichannel cost integration.

- Assist for 37 currencies and practically 100 international locations with dynamic forex conversion (DCC) — clients can settle for DCC or decline and pay in native forex.

- Native and cross-border payouts.

- Threat administration device you’ll be able to customise relying on your corporation’ acceptable danger ranges.

- Enterprise hours embody cellphone assist, in-person coaching, assist by way of ticket, and devoted account managers.

Execs and cons

| Execs | Cons |

|---|---|

| World cost choices accessible. | Advanced pricing mannequin. |

| Strong omnichannel options. | Restricted invoicing options. |

| Devoted service provider account so there are fewer possibilities of frozen accounts or account holds. | Intensive underwriting course of. |

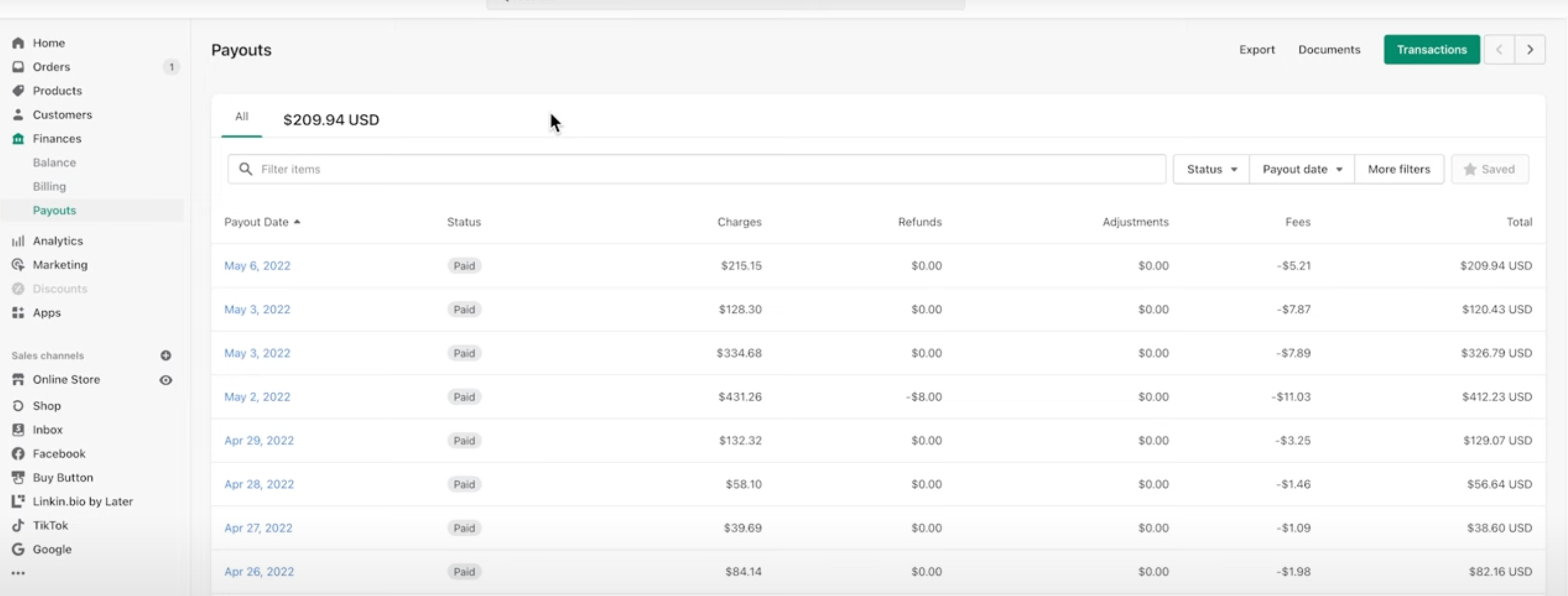

Shopify Funds: Finest Stripe various for Shopify retailers

Shopify Funds is the built-in cost processing resolution of Shopify, a highly-rated and broadly well-liked e-commerce platform that small enterprise house owners and B2B alike use. Shopify retailers can simply settle for funds on-line via their Shopify shops and in-person via the Shopify POS with out organising a separate cost gateway.

With Shopify Funds, Shopify retailers can simply handle their funds, payouts, and refunds from inside their dashboards. In case you are a Shopify retailer proprietor, Shopify Funds is the very best Stripe various for a simple set up and all-in-one setup.

Why I selected Shopify Funds

Shopify Funds is a good Stripe various for Shopify companies due to its straightforward setup and seamless integration with the remainder of Shopify’s instruments. I like that utilizing Shopify Funds waives the transaction charges that Shopify in any other case prices to make use of a third-party cost supplier. Retailers can save on processing prices whereas nonetheless benefiting from Stripe’s dependable infrastructure since Shopify Funds is powered by Stripe.

Nonetheless, Shopify Funds is unique to the platform and doesn’t assist prompt payouts, so this might be limiting for some. Nonetheless, it’s nonetheless the very best Stripe various for Shopify retailers or these contemplating Shopify as an e-commerce platform.

Pricing

Shopify Funds is constructed into Shopify service provider accounts and has a flat-rate transaction payment construction. Whereas it doesn’t have month-to-month or setup charges, it’s essential to subscribe to a paid month-to-month subscription to Shopify’s e-commerce platform. Shopify e-commerce plans vary from $5 per 30 days (for social promoting) to $399 per 30 days. Be aware that the $5 per 30 days plan has a better transaction payment of 5% for in-person transactions and 5% plus 30 cents for on-line transactions.

- Subscription payment: $0.

- On-line transaction: 2.4% + 30 cents to 2.9% + 30 cents.

- Bill processing: 2.4% + 30 cents to 2.9% + 30 cents.

- Forex conversion payment: 1.5% (U.S.) and a pair of% (all different supported international locations and areas).

- Chargeback payment: $15.

Options

- Waived transaction charges if you’re utilizing the Shopify e-commerce platform (0.5% to 2% for third-party cost processors).

- POS {hardware} for in-person promoting.

- Deposit pace — subsequent enterprise day for Shopify Steadiness (in-house steadiness account) or as much as 5 enterprise days for exterior financial institution accounts; no prompt payouts.

- Saved funds and one-click checkout (Store Pay).

- Comparatively low chargeback charges.

- Constructed-in fraud evaluation device.

- Wonderful buyer assist — 24/7 dwell chat, e-mail, and cellphone.

Execs and cons

| Execs | Cons |

|---|---|

| Full integration with Shopify platform. | Unique to Shopify. |

| Accelerated checkout (Store Pay). | No prompt payouts, lengthy deposit switch (as much as 5 enterprise days). |

| Constructed-in fraud evaluation device. | Requires a minimum of a $39 ecommerce plan to waive transaction charges. |

PaymentCloud: Finest Stripe various for high-risk companies

PaymentCloud is the very best Stripe various for companies working in industries equivalent to CBD, vape, grownup leisure, and others, that are often tagged as high-risk by conventional cost processors. Stripe doesn’t assist such industries, and PaymentCloud gives providers you’d discover in Stripe, equivalent to bank card processing, ACH processing, and e-check processing.

Recognized for its excessive approval charge and hands-on method to purchasers, PaymentCloud is a lifeline for high-risk retailers when different processors, together with Stripe, are prone to decline their functions.

SEE: Stripe’s record of prohibited and restricted companies

Why I selected PaymentCloud

PaymentCloud is my prime advice for the very best high-risk service provider account. It has partnerships with greater than 10 banks and assigns you a devoted account supervisor who will work with you out of your software to onboarding. Plus, you get 24/7 buyer assist thereafter.

As a service provider account, it will probably work with all cost gateways, together with Stripe, to get the very best of each worlds. Pricing stays undisclosed, however person evaluations say it’s nonetheless aggressive. An extended software course of is anticipated as a result of nature of the service provider’s trade. PaymentCloud remains to be the very best Stripe various if you happen to promote high-risk merchandise or run a mid- or high-risk enterprise.

Pricing

PaymentCloud solely supplies {custom} pricing to retailers. Interchange plus pricing is offered relying on the use case; retailers are suggested to inquire for extra data. Giant quantity reductions can be found, and PaymentCloud doesn’t have software, setup, or annual charges.

The charges under are estimates supplied by the supplier:

- Month-to-month payment: $10-$45.

- Cost processing charges:

- 2%-3.1% for low-risk transactions.

- 2.3%-3.4% for medium-risk transactions.

- 2.7%-4.3% for high-risk transactions.

- Cost gateway payment: $15/month.

- Chargeback payment: $25-$50.

Options

- Excessive-risk service provider assist; PaymentCloud has a full record of suitable industries.

- Works with all cost gateways.

- Compliant bank card surcharging.

- Cryptocurrency funds.

- Fraud and chargeback safety.

- Chargeback administration.

- Subsequent-day funding.

- Devoted and hands-on onboarding assist.

Execs and cons

| Execs | Cons |

|---|---|

| Good buyer evaluations. | Cost gateway prices. |

| Aggressive charges. | Longer software and approval course of. |

| Excessive approval charge for high-risk retailers. | Undisclosed pricing. |

Do you want an alternative choice to Stripe?

Even with Stripe main the pack in most of TechRepublic’s suggestions relating to service provider accounts and cost processors, there are the reason why Stripe is probably not the most suitable choice for your corporation; I record the explanations under.

- Sure, if you happen to want robust omnichannel cost instruments, notably for in-person gross sales.

- Sure, if you happen to want an easy-to-use, easy, and easy resolution that doesn’t want coding data.

- Sure, if you happen to want built-in or native integrations or all-in-one packages or options.

- Sure, if you happen to want discounted or decreased charges for prime quantity enterprise or authorities gross sales

Methodology

To give you my advisable Stripe alternate options, I took a take a look at greater than a dozen Stripe opponents, principally these which are prime picks on different purchaser guides for service provider accounts and cost processing.

Then, I evaluated the suppliers primarily based on pricing and contract (20%), cost sorts (30%), gross sales and account administration options (25%), and skilled rating (25%). I additionally zeroed in on particular options that Stripe lacks and areas the place different options carry out higher. After thorough analysis and assessment, I narrowed my prime picks to seven, specializing in platforms which are straightforward to make use of and suitable with most platforms.

Often Requested Questions (FAQs)

Is there a greater various to Stripe?

Relying on your corporation wants, there are different corporations which are higher suited than Stripe. For instance, Sq. is an effective various for omnichannel or in-person promoting, PaymentCloud for high-risk companies, Shopify Funds for Shopify retailers, and PayPal for ease of use.

What’s the drawback of Stripe?

Stripe’s excessive stage of customization is a double-edged sword; it may be limiting for companies that don’t want the developer possibility and will discover it too overwhelming and tough to make use of.

Is utilizing Stripe funds value it?

Sure, whereas there are particular conditions wherein it’s your decision an alternate, total Stripe can’t be beat with its excessive stage of customization and intensive developer toolkit. There are additionally quite a lot of Stripe various cost strategies that assist worldwide currencies.

This text and methodology have been reviewed by our retail skilled, Meaghan Brophy.

————————

BSB UNIVERSITY – AISKILLSOURCE.COM